Roth ira withdrawal tax calculator

The calculator will estimate the monthly payout from your Roth IRA in retirement. In the Roth version of IRAs and 401k plans contributions are made after taxes are paid.

Roth Ira Calculator Excel Template For Free

First to avoid both income taxes and the 10 early withdrawal penalty you must have held a Roth IRA for at least five years.

. You cannot deduct contributions to a Roth IRA. Traditional IRA depends on your income level and financial goals. Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement.

You can withdraw your contributions to a Roth IRA for any reason and at any time without penalty. If you do the Roth IRA funds will become taxable. Roth IRAs A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA.

This calculator assumes that you make your contribution at the beginning of each year. To calculate the penalty on an early withdrawal simply multiply the taxable distribution amount by 10. That is it will show which amounts will be subject to ordinary income tax andor.

Ready To Turn Your Savings Into Income. It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax. For example an early distribution of 10000 would incur a 1000.

Your Age 5-Year Rule Met Taxes and Penalties on Withdrawals Qualified Exceptions. Call 866-855-5635 or open a. Traditional IRA Calculator can help you decide.

For 2022 the maximum annual IRA. Roth IRA Distribution Tool This tool is intended to show the tax treatment of distributions from a Roth IRA. At retirement also after age 59 12 contributions and earnings can be withdrawn tax-free.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. Once you reach the retirement age of 59 ½ and the account has been open for.

For example if you contributed to your Roth IRA in early April 2020 but designated it for the 2019 tax year youll only have to wait until Jan. Distributions from a Roth IRA may be subject to income taxes and in some cases the 10 penalty. Here are a few common scenarios to consider.

Roth IRA Withdrawal Rules. Roth IRA Taxable Distribution Examples. First say that youre 55 years old and opening a Roth IRA for.

The Roth IRA Conversion Calculator is intended to serve as an educational tool and should not be the primary basis of your investment financial or tax planning decisions. Automated Investing With Tax-Smart Withdrawals. If you are at least age 59 ½ but.

You can adjust that contribution. Some states also levy early withdrawal penalties. Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

1 2024 to withdraw your Roth IRA. This condition is satisfied if five years have passed. Choosing between a Roth vs.

When You Owe Income Tax on a Withdrawal Once you reach age 59½. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. The amount you will contribute to your Roth IRA each year.

We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Here are some examples of how Roth IRA distributions may be taxable.

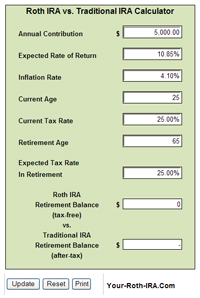

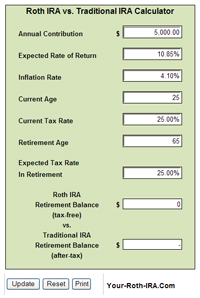

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Roth Ira Contribution

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Traditional Vs Roth Ira Calculator

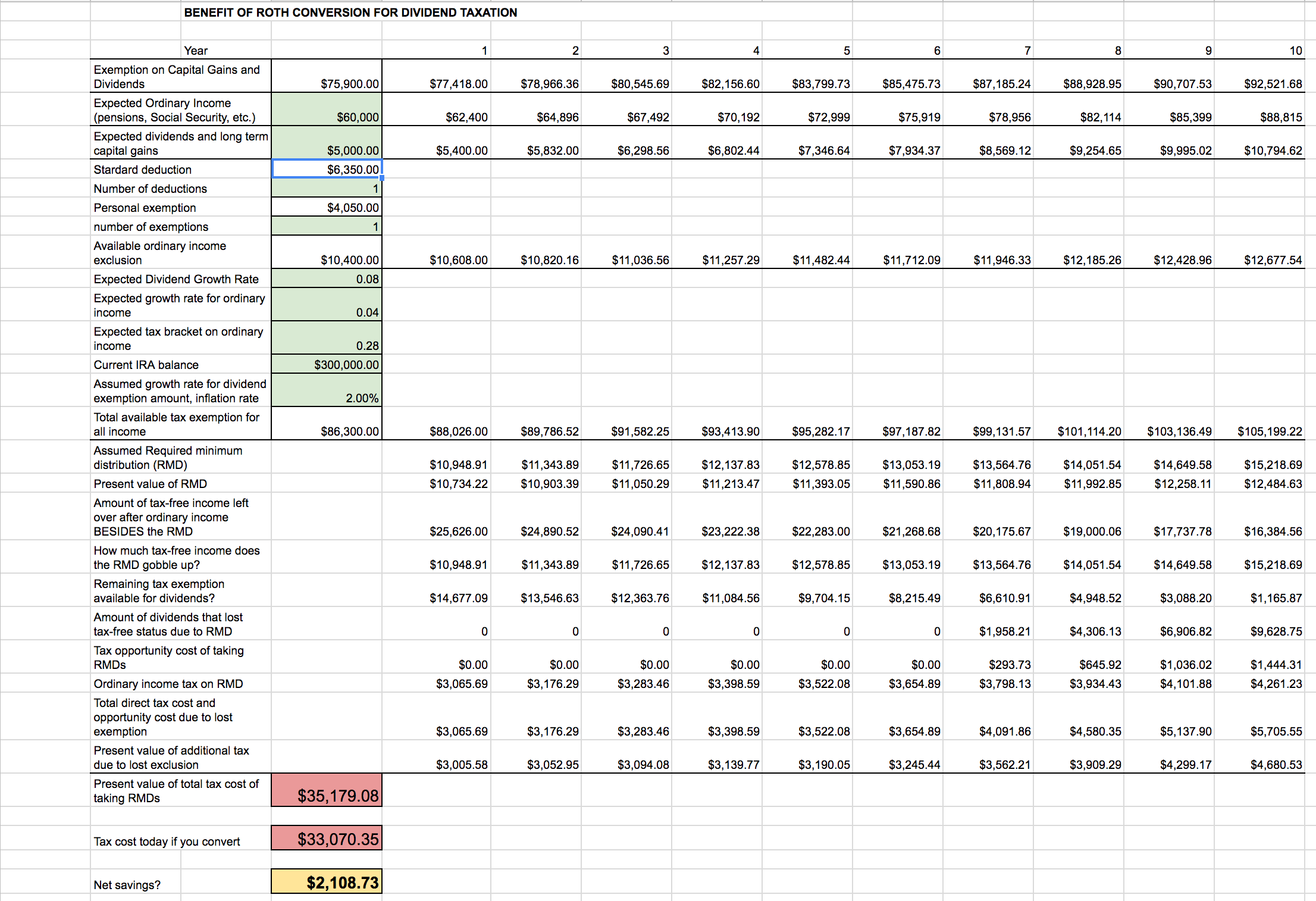

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion Calculator Excel

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Retirement Withdrawal Calculator For Excel

Roth Ira Conversion Spreadsheet Seeking Alpha

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Best Roth Ira Calculators